Table of Content

A foreclosed property offers a lot of potential value to a purchaser. Because of that, the competition for these homes can be very steep. You may find that some listings are available for 24 hours or less.

You can also contact your county court to see how you can search for notices of default. A home is in pre-foreclosure when the owner is in default on their mortgage payments and is at risk of being foreclosed upon. It is not necessary for a formal foreclosure notice to be filed in the public records for a home to be considered to be in pre-foreclosure. However, more often than not, the notice of default will be made a public record. When you agree to a sales price with the homeowner, draft a purchase agreement that is contingent on a professional inspection of the property and a full title search. Unless you are a legal expert, get a real estate agent or an attorney to help you with this.

How Long Is the Pre-Foreclosure Process?

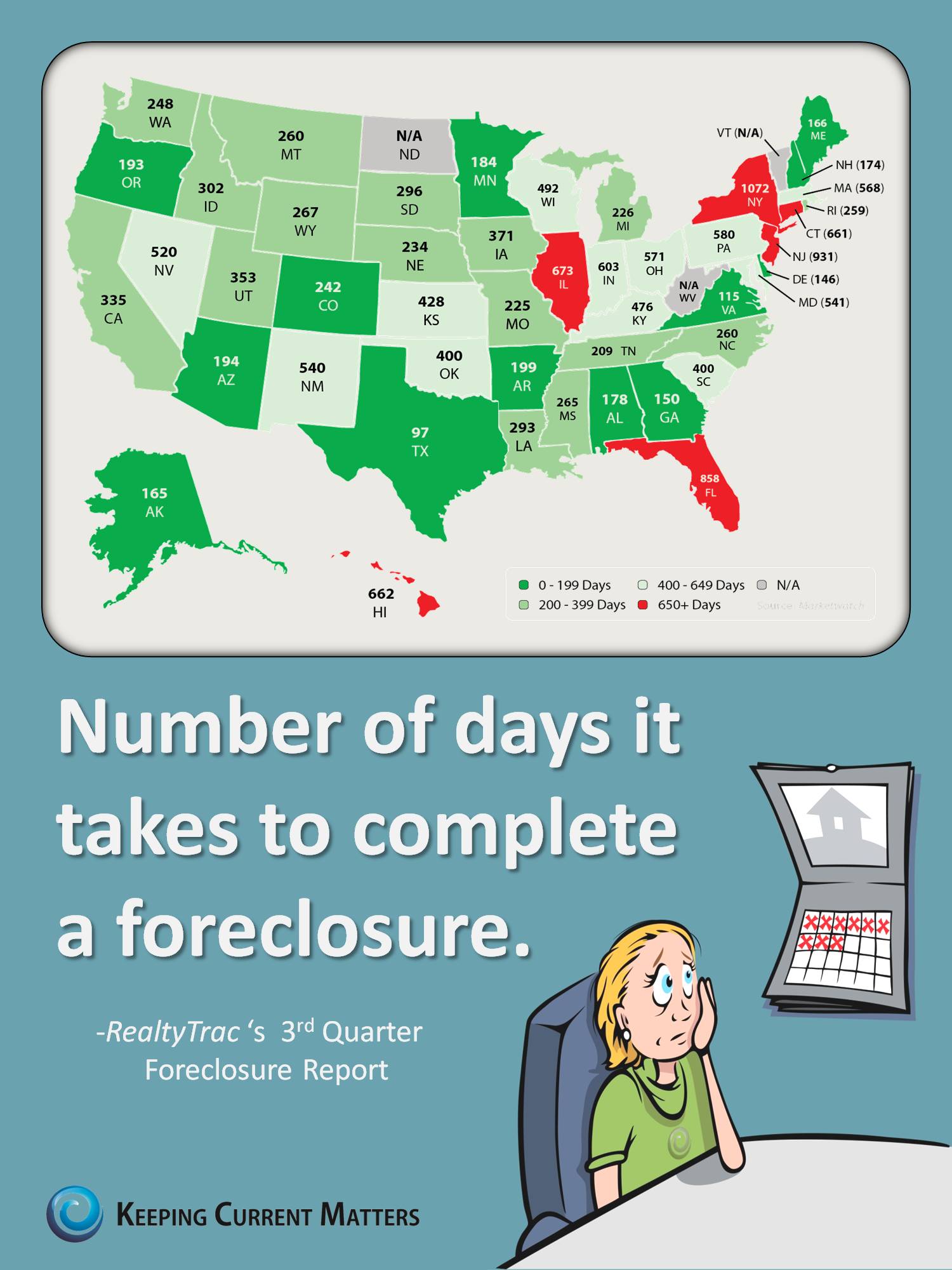

In 2021, it was reported that foreclosure rates were 67 percent higher in the third quarter compared to the previous year. That means you would have to close the deal by then, before the lender puts the house up for auction. An auction is the traditional form of selling a home that has gone through the "preforeclosure" phase. Once the auction takes place, the home is considered foreclosed. That allows aggressive homebuyers or investors to locate approach the defaulting homeowners to make an offer. Online services like foreclosures.com or realtytrac.com compile information on homes headed toward foreclosure from public records.

See Nolo's website for more information on buying foreclosed properties. There's a narrow window of opportunity in which one might buy a property from a homeowner in financial distress before actual foreclosure proceedings have occurred. Find a lender who can offer competitive mortgage rates and help you with pre-approval. Buying a pre-foreclosed home can still have some complexities and uncertainties. The seller may change their mind if their financial situation improves, or they may want to drag out the process to move out later.

Understand What Youre Getting Into With A Foreclosed Home

The basic property tax rate in Germany is 0.35%, multiplied by a municipal factor. This article will cover all the basics of a foreclosure, the different ways to buy one, and how to navigate the process. Use Mashvisor’s Property Finder tool to find off market properties easily and efficiently based on your set criteria. For the purposes of this blog, we will limit the discussion of the Mashvisor Property Marketplace to finding the property and estimating its potential returns. If you are truly opposed to the newspaper in printed form, you can always search the online edition with the same information.

Ideally, your offer will be considerably lower — perhaps 20 percent or more — than your breakeven number. For instance, an owner may be more willing to flex on price if you allow them to stay in the property for 30 to 45 days while they find a new place to live. It’s not uncommon for homeowners to resolve their financial problems, so you need to do your homework and verify whether the property is still in default. Thetrustee who filed the paperwork to initiate the foreclosure should be able to provide this information. Mortgage lendersto reduce time and optimise the mortgage loan experience.

Government-Owned Properties

Some sellers can be current on their mortgage payments and still do a short sale. Sellers who are current on their payments would not fall into the pre-foreclosure category. If they successfully do so, the home will no longer be in pre-foreclosure. If the seller remains in default and continues to stop making the mortgage payments, eventually the home will be foreclosed upon and seized by the lender or bank.

Once the mortgage lender has received the required payment order documents, they will pay out the loan. Getting a German mortgage pre-approval will help you stand out from other potential homebuyers. Use the methods above to identify pre-foreclosure homes you may want to buy. Finally, it may take longer to obtain a bidding answer, particularly if the lender is overloaded with foreclosures and might take up to 90 days to reply to an offer. If youre looking to purchase a foreclosed house, there are several drawbacks that could ultimately be a deal breaker. If you want to finance a foreclosure with a mortgage, youll need to analyze your income and expenses to determine how much house you can afford.

What can help you save some cash on the purchase of a preforeclosure, however, is working within other negotiable variables. Meanwhile, homes in preforeclosure generally have enough value to cover the outstanding mortgage. A zombie title is a title that remains with a homeowner who believes they have lost the property to foreclosure. People looking to buy foreclosures in today's market should expect to find a limited supply and competition on most deals. The more basic version, a streamlined 203 loan, is meant for limited repairs that don’t require engineering or architectural plans. Buyers can borrow up to $35,000 above the home’s sale price to cover basic repairs such as new appliances, siding, and windows.

Although most of the methods listed above cater more to experienced real estate investors, it doesn’t mean first-time investors should not try them out. Join an association for real estate investors or ask a real estate agent to refer you to one. A real estate wholesaler finds distressed houses for sale, contracts them with the owner or seller, then finds a buyer for them at a higher price than that of the seller. Unlike the house flipper, a real estate wholesaler does not do any repair or renovations to the distressed property. Many pre foreclosure properties had undergone repairs and renovations before they faced the risk of repossession, which means you don’t need to spend too much on repairs. Despite being pre-foreclosed, the property’s value will still increase so you can still enjoy a decent profit.

Check back periodically to see if it reappears in the bank’s inventory. The seller may offer additional incentives such as a reduced down payment, lower interest rate, or the elimination of appraisal fees and some closing costs. Most foreclosures are sold at a sizable discount from market value, with the exact amount varying from region to region. The federal Veterans Administration has a mortgage guarantee program that is open to current service members, veterans, and surviving spouses.

You may also learn something from them about real estate investing. However, you may have to pay a wholesaler a referral fee for giving you the leads, even if you still have to research the property. The selling homeowner will either list at a price sufficient to pay off the outstanding mortgage loan or an amount short of the full debt amount. A sale that's short of what's needed to pay off the mortgage loan is called a "short sale." Also, unless you’re an expert in real estate law and transactions, it’s a good idea to seek the counsel of an attorney and/orreal estate agentfamiliar with foreclosures. It’s not the kind of purchase where you want to wing it.Read more about buying a bank-owned property.

An agent can help you determine a good price to offer on the house, especially if you can find a contractor to estimate repair costs for you. But make sure the agent is comfortable with and has experience dealing with foreclosed homes as they are time consuming and tricky; not every agent is willing to negotiate these. It’s a process by which a bank, a mortgage company or other lien holder seeks to take a property from an owner to satisfy a debt. The bank or lender may actually take ownership of the property or have the property sold to pay off the debt. The debtors lose all rights to the property and all of the investment they’ve put into it. For these reasons, understand that if you’re dealing with the previous owner, emotions can run high.

No comments:

Post a Comment